Standard Chartered introduce X credit card for affluent millennials, positioned as the card for eXperience, eXclusivity, eXploring, eXcitement

Standard Chartered now has a metal credit card too, catered towards affluent millennials earning $80,000+ who are also attracted by the ability to choose the rewards they can redeem.

The Visa Infinite X Card according to Standard Chartered earns cardholders two Air Miles for every dollar charged, 2% Cash Rewards or Travel Credits for overseas spend versus 1.2 Air Miles and 1.2% Cash Rewards for local spend.

There is no minimum spend requirement nor cap on the amount of reward points – which do not expire – or Cash Rewards that a cardholder can accumulate.

Standard Chartered Bank Singapore’s head of credit cards and personal loans, Natalia Goh, said: “Affluent millennials are an important and growing segment for the Bank. Over the last five years, we have seen this population grow 12% annually within our base.”

Standard Chartered conducted focus group research with more than 300 affluent millennials covering spending habits, travel and credit card usage that led to the construct of this card.

With travel and experience a priority for this demographic the imagery of accompanying print ad shown here makes perfect sense.

Rewards for starting a Priority Banking relationship: Cardholders who place a minimum of S$300,000 fresh funds with a priority banking relationship with the bank will also receive an additional 100,000 Air Miles.

According to the bank, this is the highest sign-up offer in the market so far.

Travel Credits: Reward points earned on the X Card can be used for Travel Credits to offset certain travel purchases such as airline tickets, hotel accommodation and cruise packages under the SC EasyRewards Programme.

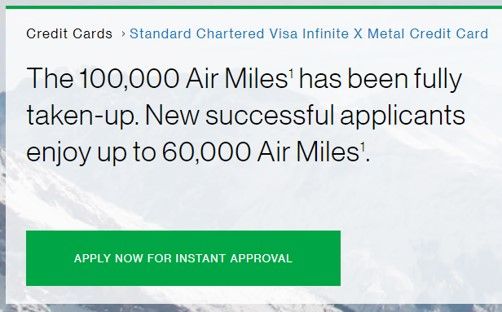

Sign up Bonus – reduced from 100,000 to 60,000 Air Miles: For a launch promotion cardholders could receive 100,000 Air Miles but within 5 days of launch this was reduced to 60,000 Air Miles because the bank states that the 100,000 Air Miles [offer] “has been fully taken up.” 30,000 Air Miles come with payment of the $695 annual fee and the further 30,000 miles with a minimum spend of $6,000 within the first 60 days (no later than 31 October 2019).