OCBC embed AI-powered voice-based virtual assistant in app and unveil 'Be Unstoppable With OCBC's Digital Solutions' campaign

In a first for Singapore, OCBC’s mobile banking app as of 19 August 2019 offers an AI-powered voice-based virtual assistant so customers can use their voice to perform banking transactions and access services. Called the OCBC Banking Assistant it has been taught how customers in Singapore talk and ‘understand’ all the potential requests from customers. Unstructured phrases commonly used in Singapore (Singlish), such as “How much I spend on dining?”, “Can show my spending pattern?” or “Can pay my bill?”

The OCBC Banking Assistant was also taught to incorporate “logic” in its responses. If the customer wants to pay a bill but does not mention the bank account to debit, the Assistant will prompt him or her accordingly. Or suppose a customer has specified an account name in making a request. The Assistant will take this cue and omit information about other accounts.

OCBC Bank was the first financial institution in Singapore to enable customers to use their voice for banking in 2018. From February 2018, customers could talk to Apple’s Siri to check their bank balances and credit card information, and to make e-payments. The Google Assistant was integrated with OCBC Bank’s services in April 2018, enabling anyone to speak to the Google Assistant.

“Voice-based conversational banking is one of our high-conviction bets as we shape the bank of the future,” said Mr Aditya Gupta, Head of Digital Business, Singapore and Malaysia, OCBC Bank. “We are bullish on the conversational AI and natural language processing technology and will continue to invest in enabling more voice-activated interactions over time.”

To use the OCBC Banking Assistant, customers simply log in to the OCBC Mobile Banking app and click the “Banking Assistant” icon. They then speak to the OCBC Banking Assistant conversationally by pressing the microphone icon – for example, by saying: “Pay $100 to Titanium card from 360 Account” – and then confirm the transaction summarised on the screen with a spoken “yes” or “confirm”. Customers have the option of typing their requests should they prefer not to use their voice.

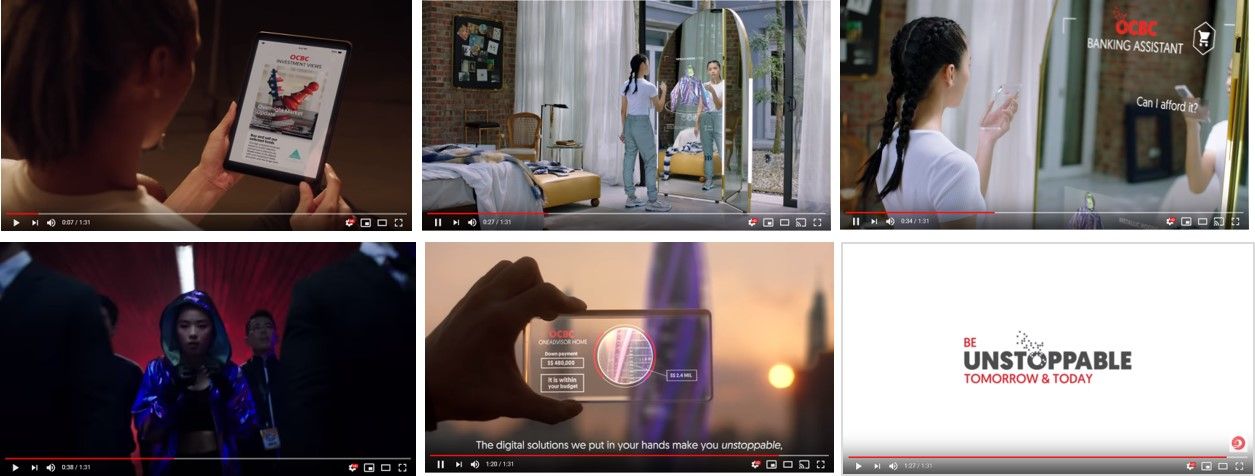

To help promote the new app capabilities and the digital solutions the bank is working on OCBC unveiled a campaign called Unstoppable which highlights the digital capabilities of today and possibilities for tomorrow that help customers be unstoppable.

Watch the campaign spot here.